Manitowoc Finance

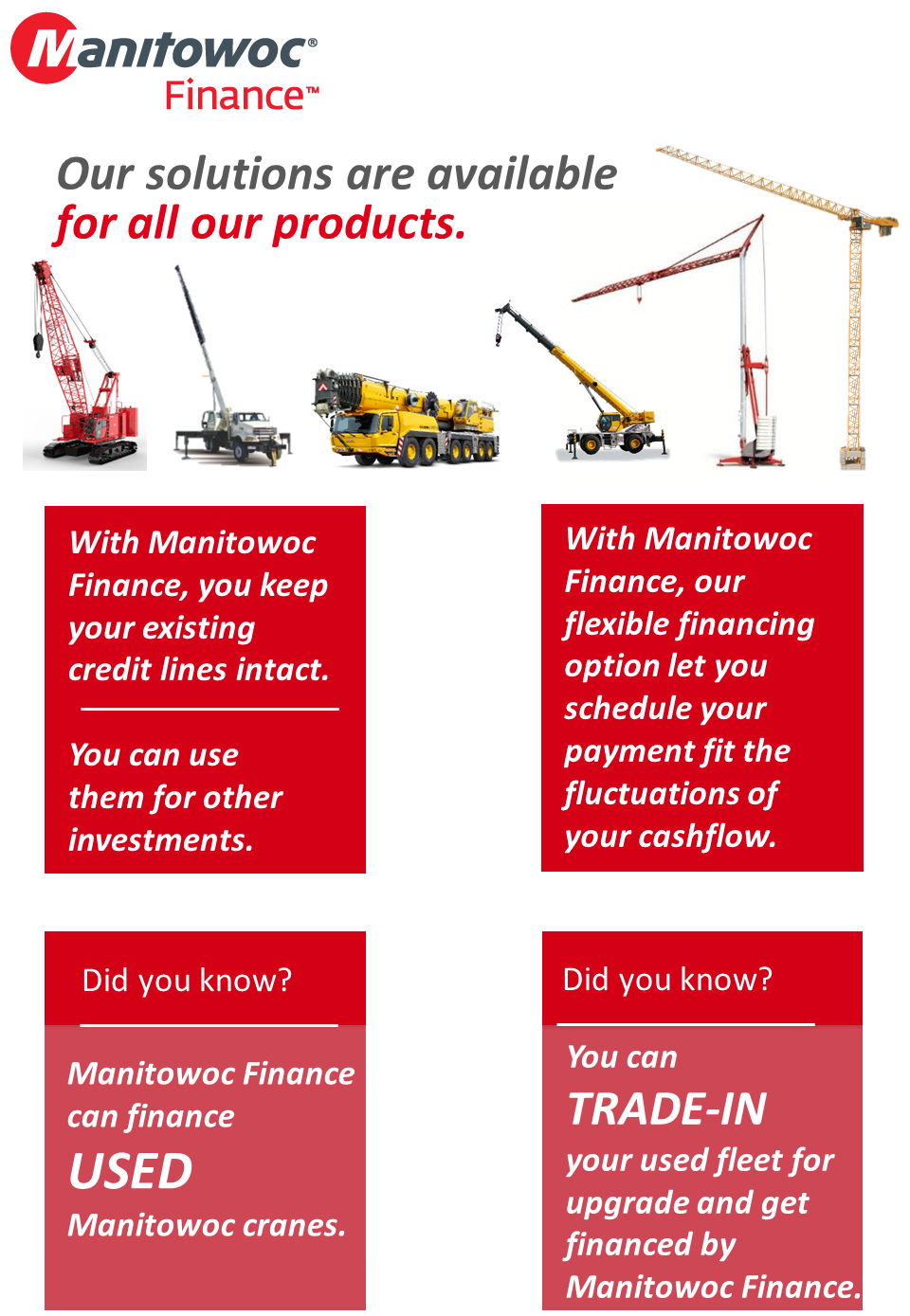

To get you in the field with the right equipment, Manitowoc Finance gives you access to flexible, affordable financing you can use to seize profitable new opportunities as they arise.

With Manitowoc Finance, equipment can be acquired with virtually no cash outlay, and unlike traditional lending, our financial products don't affect bank lines of credit. Our customers' capital resources remain intact for times when they need ready access to cash.

We offer competitive rates, and customers can take advantage of flexible financing options and payment schedules that are adaptable to virtually any business need. With Manitowoc Finance, we structure our products to put our customers in control.

Click here to get your local contact information!

Financial Options

Plenty of Flexibility and Choice

Manitowoc Finance offers a wide range of financing and leasing solutions designed to meet varying business and worksite needs. Typically, terms range from 24 to 84 months depending on the cost and type of equipment. Some of our most popular financial products are featured below.

Full Payout Loan

With a Full Payout Loan, your company has fixed payments over the term of the contract while building ownership equity in the equipment over time.

Tax or True Lease (Fair Market Value)

A Tax and True lease is an operating lease in which your company may purchase the equipment for a fair market value at lease end, extend the lease or return the equipment to Manitowoc Finance.

Fixed Price Purchase Option

With an Fixed Price Purchase Option, your company may purchase the equipment at the end of the term for the amount specified at the beginning of the term or return the equipment to Manitowoc Finance.

Early Buyout Lease

With an Early Buyout Lease, your company experiences the benefit of a Tax or True Lease (FVM) and having a one-time option to purchase the equipment at a stated amount.